** NEWS RELEASE 12/29/2022: RCAS K-12 STUDENT ENROLLMENT DECLINES TO A NEW LOW (BELOW THE PANDEMIC LOWS OF THE 2020-2021 SCHOOL YEAR).**

For the 2022-2023 school year, Rapid City School District 51-4 has 12,643 enrolled K-12 students, a decline of 108 students or 0.85% from the 2021-2022 school year. Further, RCSD 51-4 student enrollment now stands at an over 32 year low and currently has 1,230 enrolled students LESS than it had in the 1991-1992 school year. Due to this decline, the estimated loss in State Aid from the State of South Dakota is estimated to be approximately $700,000 in the 2022-2023 school year, yet there have been no publically announced RCAS budget cuts to compensate for this large fiscal shortfall.

SCHOOL CHOICE IS ABOUT TO REVOLUTIONIZE K-12 EDUCATION! The taxpayers should not be forced to fund an irrevocably broken public school system with their hard-earned money. Public K-12 taxpayer money should fund STUDENTS, not broken public school systems. The time for SCHOOL CHOICE in South Dakota is now!

ARIZONA SCHOOL CHOICE LAW SETS NEW STANDARD FOR NATION (JULY 2022)

** NEWS RELEASE 9/29/2021: THE 2021-2022 BUDGET FOR RAPID CITY SCHOOL DISTRICT 51-4 (RCSD 51-4) HAS SPIRALED OUT-OF-CONTROL AND IS NOW $8,999,015 IN THE RED. THE RCAS BUDGET CRISIS NEEDS TO BE ADDRESSED IMMEDIATELY! **

HERE IS AN EXCELLENT COST CUTTING IDEA - SIGNIFICANTLY CUT RCAS ADMINISTRATIVE DEADWEIGHT ACROSS THE BOARD AND PERMANENTLY CLOSE THE RAPID CITY EDUCATION CENTER (RCEC) AS IS SIMPLY AN UNNECSSARY AND WASTEFUL TAXPAYER FUNDED EXPENSE. There is simply no legitimate reason for the number of RCAS administrators to keep increasing (116 employees as of 11/30/2020) every year when student enrollment is at an over 30 year low. This is a prime example of "empire building" of the taxpayer paid bureaucracy which has only NEGATIVELY impacted student academic performance since 2016.

The ANNUAL salary cost of these 116 RCAS administrators is $8.764 million as of 11/30/2020. The ANNUAL salary + benefit cost of these 116 RCAS administrators is approximately $11.832 million as of 11/30/2020. The number of RCAS administrators and the associated costs of these administrators are at all time highs yet student enrollment remains at an over 30 year low! Is this the real reason why RCSD 51-4 long-term debt continues to increase and is now $83.6 million as of 6/30/2021? Is this the real reason a record high of $6.25 million will be transferred this year from the Capital Outlay fund to the General Revenue fund. This was approved by the PRIOR Rapid City Board of Education at their 7/26/2021 meeting under AGENDA ITEM 7A. The purpose of the Capital Outlay fund is for major building renovations, remodels, and new construction -- not for bureaucrat salaries, not for the RCEC, and not for indoctrination programs.

DOWNLOAD HERE -- the RCAS K-12 Employee Salary List as of 11/30/2020.

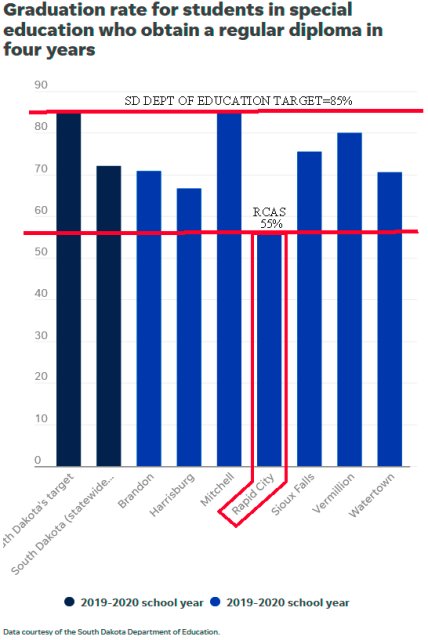

** BREAKING NEWS 6/4/2021: RCAS HAS THE LOWEST ON-TIME GRADUATION RATE FOR SPECIAL EDUCATION STUDENTS OF THE SEVEN LARGEST SD SCHOOL DISTRICTS INCLUDED IN AN ARGUS LEADER STUDY. **

SOUTH DAKOTA NOT MEETING GRADUATION RATES FOR SPECIAL EDUCATION STUDENTS

Using the most recent 2019-2020 data, RCAS had an on-time graduation rate of only 55% for special education students. This on-time graduation rate is 30 percentage points BELOW the SD Department of Education’s 85%target. In addition, RCAS’ performance was, by far, the LOWEST of all the seven largest school districts in South Dakota included in the study as can be seen the in chart below. The RCAS voters should consider whether such abysmal academic performance by the current RCAS administration is acceptable. If the voters care about the best interests of all RCAS students, one can only conclude that both need to be replaced immediately.

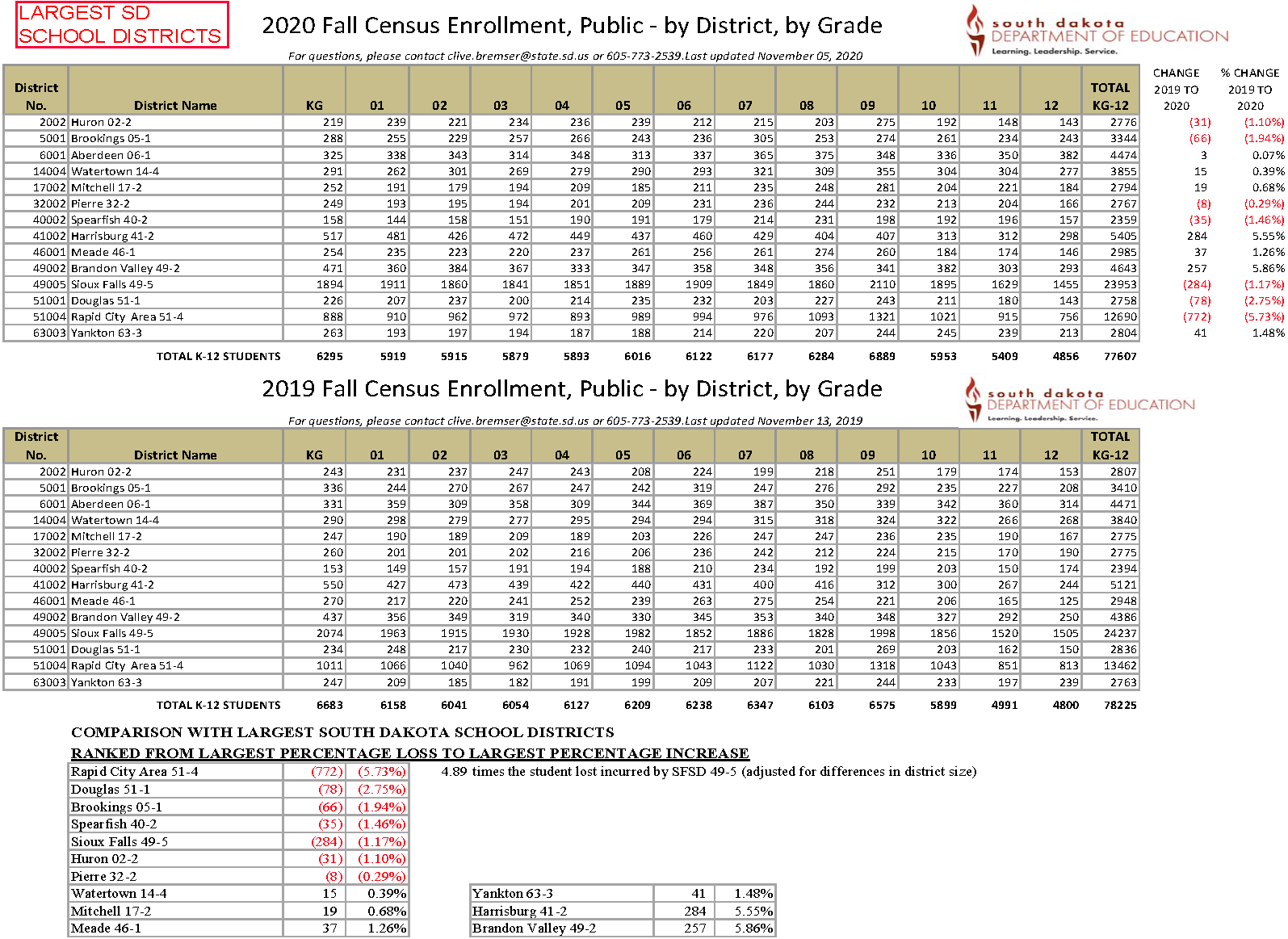

**NEWS RELEASE 11/20/2020: COMPARING RAPID CITY SCHOOL DISTRICT 51-4 RECORD DECLINE IN STUDENT ENROLLMENT TO THE 13 LARGEST SOUTH DAKOTA PUBLIC K-12 SCHOOL DISTRICTS FOR THE 2020-2021 SCHOOL YEAR!! **

The exodus of students departing RCAS continues unabated. As shown above, coronavirus is simply a lame excuse, not the true underlying reasons that RCAS suffered a Record Decline in Student Enrollment for the 2020-2021 School Year. Until the true reasons for these failures are directly addressed, RCAS enrollment shall continue to decline for the foreseeable future.

DOWNLOAD HERE - THE ABOVE TABLE to view the record RCAS enrollment decline as compared to 13 of the largest South Dakota school districts. As you can see both the magnitude and percentage of decline is unique to RCAS!

**NEWS RELEASE 11/9/2020: RECORD DECLINE IN RCAS STUDENT ENROLLMENT FOR THE 2020-2021 SCHOOL YEAR!! **

For the 2020-2021 school year, Rapid City School District 51-4 has 12,690 enrolled K-12 students, a RECORD decline of 772 students or 5.73% from the 2019-2020 school year. Further, RCSD 51-4 student enrollment now stands at an over 30 year low and currently has 1,183 enrolled students LESS than it had in the 1991-1992 school year . Due to this large decline, the estimated loss in State Aid from the State of South Dakota is estimated to be approximately $2.35 million in the 2020-2021 school year, yet there have been no publically announced RCAS budget cuts to compensate for this massive fiscal shortfall.

At the same time, the number of homeschooled students within the territorial boundaries of RCSD 51-4, reached an all time record of 1,078 students and remains the highest number of homeschooled students within the State of South Dakota as measured by school district. In addition, in RCSD 51-4 the ratio of homeschooled students to public enrolled students is 1,078/12,690 or 8.5%. The second highest number of homeschooled within the territorial boundaries of Sioux Falls School District 49-5 (SFDS 49-5) at 873 students but with 23,953 enrolled students the ratio of homeschooled students to public enrolled students is much lower at 873/23,953 or 3.6%. In other words, within the boundaries of RCSD 51-4, students are choosing homeschooling over public schooling at a rate 2.33 times higher than in the SFSD 49-5. The root causes and reasons behind this large discrepancy should be researched in detail.

Of even greater concern is the fact the enrolled student population in RCAS elementary schools is declining faster than all others with a loss of 628 students or 10.06% year-to-year. Currently, there are 1,338 “empty seats” in RCAS elementary schools districtwide which is equivalent to 2.9 empty elementary schools using the capacity calculations from the 2016 MGT Report. The enrolled student losses were significantly less at the Middle School level with a loss of 132 students or 4.13% year-to-year and a loss of 12 students or .30% year-to-year at the High School level. Using various statistical analysis techniques, this data indicates a declining RCAS K-12 student enrollment for the foreseeable future. The district's false narrative of a "growing school district" (particularly at the elementary school level) has been permanently disproven!

The good news is due to the substantial declines in RCAS student enrollment districtwide, construction of NEW schools simply won’t be necessary for an extended period of time, reducing the burden on the overtaxed local taxpayer. If the RCAS student population shifts geographically, the RCSD 51-4 Board of Education should take proactive measures to adjust school boundary lines as necessary to resolve these minor issues as they occur.

NOTE: All data above provided by the South Dakota Department of Education (last updated 11/5/2020).

Reference the Demographics page for more in depth information including graphs and tables.

Reference the Overcrowding? page which proves overcrowding simply does not exist in the Rapid City Area Schools for both the current school year and the foreseable future.

RCSD 51-4 STUDENT ENROLLMENT, CURRENT BUILDING UTILIZATION, AND CAPACITY BY SCHOOL AS OF THE 2020-2021 SCHOOL YEAR - DOWNLOAD HERE

SCHOOL BOND ELECTION NEWS:

** WE THE PEOPLE WON THE FEBRUARY 25, 2020 SCHOOL BOND ELECTION!! WE AVOIDED A $309.5 MILLION TAXPAYER RIPOFF THAT THE PEOPLE SIMPLY COULD NOT AFFORD. THE TRUE PURPOSE OF THE SCHOOL BONDS WAS SIMPLE -- A HUGE MONEY GRAB, AS CURRENT SCHOOL BUILDINGS REMAIN SIGNIFICANTLY UNDERUTILIZED. **

** Video of debate between both sides on the RCAS School Bond, KEVN Focus February 2020 with TSSB board members Jay Davis and Tonchi Weaver. An excellent representation of the precise reasons why Taxpayers for Sensible School Bonds (TSSB) was formed to appropriately serve We the People in this critical issue! **

POSITION PAPER - DOWNLOAD HERE. Written by a very concerned local citizen, please read and draw your own conclusions.

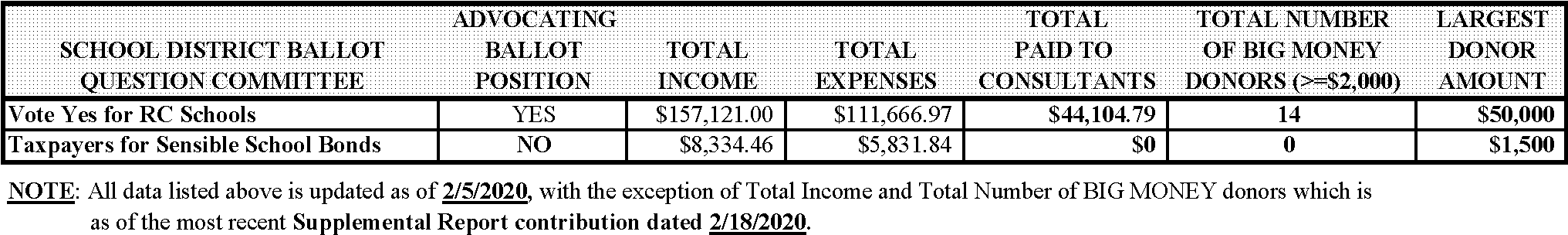

** RCAS SCHOOL BOND VOTERS: Since the Vote Yes for RC Schools campaign has concluded they cannot win on the “merits” of the $309.5 million (Principal + Interest) School Bond, it now appears that they have changed tactics. The Vote Yes for RC Schools campaign is so desperate they are now attempting to distract the voters with slander, a bogeyman, and attacks on religion. These are nothing but underhanded and diversionary tactics in an attempt to push the voters to look at anything OTHER THAN THE ACTUAL FACTS OF THIS SCHOOL BOND. Is this the best advice that the Vote Yes for RC Schools campaign could get for the $44,104.79 they spent (as of 2/5/20) on unidentified consultants? Contrast that to Taxpayers for Sensible School Bonds who spent exactly ZERO on consultants (as disclosed below) since we didn't need anyone to hold our hand. If any group is dividing Rapid City it is the Vote Yes for RC Schools campaign and their BIG MONEY corporate, “non-profit”, and government donors. The Vote Yes for RC Schools campaign actions are simply reprehensible! Your vote matters, VOTE NO! **

CURRENT CAMPAIGN FINANCE DISCLOSURE REPORTS FILED FOR BOTH CAMPAIGNS:

Vote Yes for RC Schools, All Vote Yes reports filed as of 2/13/2020.

Taxpayers for Sensible School Bonds, All VOTE NO reports filed as of 2/13/2020.

For those who don’t wish to read the full finance disclosure report, here’s the complete listing of the Vote Yes for RC Schools BIG MONEY ($2,000+) donors:

Elevate Rapid City $50,000; Black Hills Power, Inc $25,000; Stanford Adelstein $10,000; Sanford Health $10,000; Scull Construction Service, Inc $10,000; Hani Shafai $5,000; RCS Construction, Inc $5,000; Independent Insurance Agents of Rapid City $5,000; Rapid City Education Association $2,500; Black Hills Harley Davidson $2,500; David Gustafson $2,500; First Interstate Bank Rapid City $2,000; West River Electric Association $2,000, and Darren Harr $2,000. Regarding local media, keep in mind that the Rapid City Journal contributed to the Vote Yes for RC Schools campaign through their support as a Crazy Horse Platinum Investor in Elevate Rapid City and hence they are listed as a contributor on Pages 10-13 and Pages 23-26 of the Vote Yes End of Year Campaign Finance Disclosure 12-31-2019. FOLLOW THE MONEY!

The Vote Yes for RC Schools campaign is almost exclusively made up of BIG MONEY, out-of-touch Rapid City Elites and the corporate, “non-profit” and government entities they control. The Vote Yes for RC Schools campaign is an elitist organization - the antithesis of a grassroots organization! How can the Rapid City Elites claim to care about the poor or the middle class when approval of this 25 year, $309.5 million (Principal + Interest) school bond is a form of indentured servitude for the poor and the middle class for a generation. Don’t worry, this is only Phase I of the elite’s debt scheme. Phase II of their debt scheme starts in the year 2026 and Phase III starts in the year 2033!

THREE BIG QUESTIONS SCHOOL BOND VOTERS SHOULD ASK THEMSELVES:

(1) What do these BIG MONEY Vote Yes for RC Schools donors expect to receive in return for such large campaign contributions?

(2) Why are the Vote Yes supporters so desperate for this particular school bond with its undisciplined and poorly thought out process to pass? Keep in mind the school district could come back with a REVISED plan that has a laser like focus on ACTUAL student academic building needs in an election as early as June 2, 2020 if this school bond does not pass.

(3) Why does this bond intentionally create problems – 324 at-risk students at Rapid City High School evicted with no credible plan for relocation; Canyon Lake ES school closed and not replaced, etc? Oh that right, that’s what the Phase II bond in 2026 is for – to clean up the intentional mess made with the 2020 school bond.

In stark contrast, Taxpayers for Sensible School Bonds (TSSB) is a 100% volunteer, grassroots organization with the sole purpose to serve the voters/taxpayers and provide them all the information and publically data available on the February 25, 2020 School Bond election in the most objective way possible. We hold a deep respect for decisions made by an informed electorate. As you can see in both the table as well as from our campaign finance disclosure reports above, we are a small money ballot question committee. Our finances simply did not allow us to pay consultants and of course none were hired. In this school bond campaign, the only ballot question committee which has hired consultants is the Vote Yes for RC Schools campaign in the amount of $44,104.79. So why didn't Vote Yes for RC School list the company name, city and state of their hired consultants in their Finance Disclosure Reports? What are they intentionally hiding from the voters? Oh that's right, they don't want the Voters to discover the truth. The Vote Yes for RC Schools campaign has mastered the art of projection, casting aspersions, and misinformation. TSSB represents the interests and values of the average person paying property taxes to Rapid City Area Schools (either directly through owned property or indirectly through rent). TSSB represents We the People and hence is not beholden to special interest groups or BIG MONEY donors! We fight for YOU! Make your voice heard and please vote NO on February 25, 2020!

** DO YOU LIVE OUTSIDE RAPID CITY? DO YOU KNOW IF YOUR PROPERTY IS WITHIN THE RCAS SCHOOL BOUNDARIES? HIGH RESOLUTION RCAS VOTER BOUNDARY MAP - DOWNLOAD HERE. IF YES, AS A REGISTERED VOTER YOU CAN VOTE IN THIS ELECTION! **

INTRODUCTION:

On February 25, 2020 all voters that reside within the school boundaries of Rapid City School District 51-4 (abbreviated hereafter RCSD 51-4 or RCAS) Rapid City School District School Area Map will have an opportunity to vote Yes or No on the $189.553 million school bond. Per SDCL 6-8B-2, a minimum of 60% + 1 vote is required for approval of the school bond. This is due to the fact that the approval of the school bond would create an additional parallel property tax system above and beyond the current maximum Mill Levy mandated under state law for the life of the school bond. Proceeds from the issuance of school bonds should only be used for emergency situations which are absolute necessities. In our opinion, any other use of school bond proceeds are neither appropriate nor reasonable.

The purpose of this website is provide the RCSD 51-4 taxpayers/voters an objective analysis based on fact so that they can make informed decisions at the ballot box. The Board of Taxpayers for Sensible School Bonds holds a deep respect for decisions made by an informed electorate. The information provided herein simply has not and will not be disseminated to the voters from Rapid City School District 51-4, Rapid City Board of Education, or from the local news media.

Consider the basic facts of the $189,553,000 RCSD 51-4 school bond:

(1) If approved by the voters, the proposed $189.553 million bond will be tied for the LARGEST school bond in South Dakota history as measured by bond principal AND as seen in (6) below, shall be by far the LARGEST school bond in South Dakota history as measured on both a per enrolled student basis (1.8x larger) and on total property tax base (1.6x larger).

(2) Using the bond assumptions given by RCSD 51-4, the proposed bond is $189.553 million of Principal value and $101.1 $119.9 million of Interest, for a total of $290.6 $309.5 million to be repaid over the next 25 years by all property owners within the boundaries of RCSD 51-4. Please note that the above numbers do not include any type of potential bond issuance costs (e.g. underwriter costs, bond syndicate costs, OID, etc).

(3) If approved by the voters, the additional parallel property tax system will be levied against all property owners within the boundaries of RCSD 51-4 starting in the 2020 tax year (retroactive back to 1/1/2020) and continuing every single year to the 2045 tax year. As noted in (5) below this does NOT include Phase II and Phase III bond issuance and their respective bond principal and interest repayment schedules.

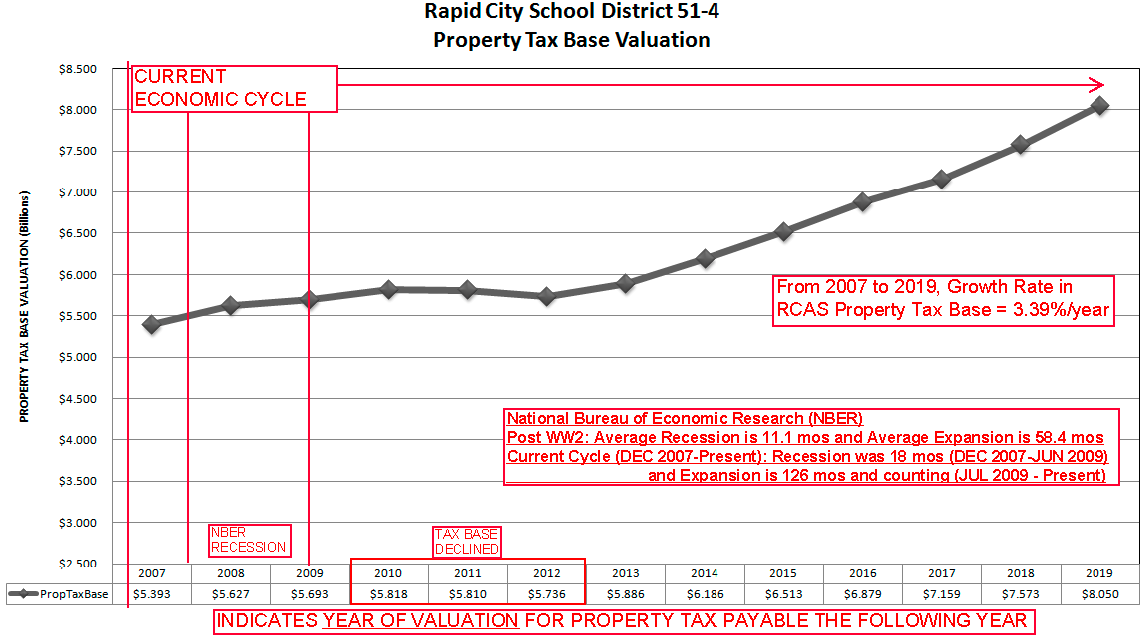

(4) In the process of developing the Facilities Final Plan for Phase I construction, RCSD 51-4 has gone through three FOUR different iterations of the School Bond and the associated tax levy impact. School Bond Iteration #1 of "RCAS annual property tax impact estimate" indicated that a $2.3726 per thousand valuation tax would be needed of all property owners to support the $250 million principal value, 20 year, mortgage style amortization method school bond. School Bond Iteration #2 of indicated that a $1.00 per thousand valuation tax would be needed of all property owners to support the $250 million principal value, 25 year school bond. School Bond Iteration #3 indicated that a $0.85 per thousand valuation tax would be needed of all property owners to support the $189.553 million principal value, 25 year school bond. However, School Bond Iteration #3 appears to be based on the assumption that recessions never happen and the RCSD 51-4 property tax base increases at 5.4% 4.5% (See Footnotes A and B below) per year every single year. Both of which seem to be speculative assumptions! School Bond Iteration #4 was identical to School Bond Interation #3 but replaced mortgage style amortization with a very speculative method of amortization (deferred principal repayment switch to percentage increase repayment amortization method). Beware of "teaser rates" or "bait and switch techniques" – if the school bond is approved by the taxpayers, the property tax rate can be increased at any time by a simple majority vote of the then current RCSD 51-4 Board of Education. In other words, in order to provide clarity and transparency to the taxpayers on what the expected property tax rate and taxes will be for the school bonds (from 2020 to 2044) requires providing a projected range of Mill Levies based upon reasonable assumptions. This is shown in EXHIBIT 2 and models both the best and worst case scenarios for the property tax base. We are very confident the actual Mill Levy and Property Taxes will reside somewhere near the HIGHER END (approximately 125 mills) of the “Projected Range” for each as shown in EXHIBIT 2, reference the Conclusions page for more in depth information. What this means in percentage terms is Owner Occupied property will see a 10.7% to 19.4% increase in the school tax on their property starting with the 2020 tax year and this will continue to the 2044 tax year. Agricultural property will see a 14.2% to 25.8% increase in the school tax on their property starting with the 2020 tax year and this will continue to the 2044 tax year. Non-Ag & Utilities property will see a 7.5% to 13.7% increase in the school tax on their property starting with the 2020 tax year and this will continue to the 2044 tax year. Again this includes ONLY the tax impact of the Phase I School Bond - there has been no information released to the public on the Phase II or Phase III School Bonds. The real question is what happens in Year 7 (2026) after all Phase I construction is complete and all bond proceeds are consumed - will RCAS 51-4 ask the voters to approve the Phase II School Bonds at that time and hence "double stacking" the School Bond property taxes as the Phase I School Bonds are not paid off until the Year 2044? A similar question should be asked in Year 13 (2031) after all Phase II construction is complete and all bond proceeds are consumed - will RCAS 51-4 ask the voters to approve the Phase III School Bonds at that time and hence "triple stacking" the School Bond property taxes as the Phase II School Bonds are not paid off until the Year 2050?

Footnote A: A RCJ Article dated 5/30/19 states, “School Business Manager David Janak and Tobin Morris, a district financial consultant from the Pierre-based firm Dougherty & Company (read the Disclosures section), said last Thursday that growth they expect the schools to experience should provide enough money to offset the lower levy. But the lower tax hinges on an estimated annual growth of 5.4 percent, a figure that several school board members appeared hesitant to believe wholesale. Janak and Morris said that there should be enough money in the school's general fund to pay back the obligation even if growth varies from that figure, and that capital outlay funds will be freed up after existing debts are paid off in about 10 years time. But future schools (school boards) will still have the ability to increase the tax as they set (see) fit.”

Footnote B: A RCJ Article dated 1/9/20 indicated that RCAS is now assuming a 4.5% annual growth rate in the RCSD 51-4 property base.

EXHIBIT 1: RCSD 51-4 PROPERTY TAX BASE VALUATION, 2007-2019 (SOURCE: SD DEPARTMENT OF EDUCATION, PENNINGTON COUNTY EQUALIZATION OFFICE)

** As can been seen in the EXHIBIT 1 above, in the CURRENT economic cycle from 2007 to 2019 the ACTUAL number is 3.39% annual growth rate in the RCSD 51-4 property base. This growth rate has a SUBSTANTIAL IMPACT on the cash flows derived from the primary cash flow source (property taxes paid by the applied mill levy) to support the principal and interest payments of the bond. The lower the annual growth rate, the higher the probability of increases in the mill levy and/or long-term support of the bond using the secondary cash flow source (General Revenue fund or Capital Outlay fund). The question is why is RCSD 51-4 using an over-optimistic 4.50% growth rate in their bond mechanics assumptions for the 25 year life of the bond? Prudence would dictate the use of a real-world observable property tax growth rate of no greater than 3.39% to provide financial protection (a margin of safety) for the taxpayers so the taxpayers are not left literally “holding the bag” on this school bond.**

EXHIBIT 2: RCAS (YEAR 1 ONLY) PROPERTY TAX IMPACT ESTIMATE OF PHASE I SCHOOL BONDS - $189.553 MILLION PRINCIPAL VALUE, 25 YEAR (ANALYSIS OF PUBLICLY AVAILABLE DATA)

EXHIBIT 3 below quantifies the School Bond Property Tax Impact for the “average home” over the life of the 25 year RCSD 51-4 bond. The RCAS Bond Fast Facts sheet defines it thus “the average home in Rapid City, which is worth about $250,000.” As EXHIBIT 3 indicates, for the Average Household within the boundaries of RCSD 51-4, the School Bond will cost them $11,393.52 over the next 25 years. The School Bond is an $11,393.52 decision for the average household.

EXHIBIT 3: RCAS ANNUAL PROPERTY TAX IMPACT ESTIMATE OF PHASE I SCHOOL BONDS - ON THE “AVERAGE HOME” WITH CURRENT TAX APPRAISAL OF $250,000 (ANALYSIS OF PUBLICLY AVAILABLE DATA)

** CALCULATE THE PROPERTY TAX IMPACT OF THE SCHOOL BOND ON YOUR HOME, BUSINESS, OR FARM - DOWNLOAD EXCEL FILE **

(5) The $189.553 million school bond is for Phase I projects only (Six Year Plan)! The RCSD 51-4 administration is currently planning on issuing additional bonds for both Phase II and Phase III, respectively! No information on the principal amount, timing, and technical rationale for the Phase II and Phase III bonds have been issued by RCSD 51-4. Will RCSD 51-4 be back at the “taxpayer well” again in 2026 (Year 7) to issue Phase II bonds, even though the Phase I bonds will not paid off until 2044? One can reasonably conclude one can definitely conclude that RCSD 51-4 taxpayers simply would be drowned in a sea of debt (summation of: Phase I Bonds $290.6 $309.5 million P&I + Phase II Bonds unknown amount + Phase III Bonds unknown amount + $81.0 million in long-term debt on the balance sheet at 8/31/19 = $371.6 $390.5 million + a very large unknown amount) with a never ending expiration date! Shouldn't the ENTIRE size of the tax bill be made transparent by RCSD 51-4 to the voters BEFORE the election so they can make an informed decision?

(6) At the beginning of the 2020-2021 school year, RCSD 51-4 is the second largest school district in South Dakota with 12,690 enrolled students. Sioux Falls School District 49-5 (SFSD 49-5) is by far the largest school district with 23,953 enrolled students or 88.75% larger. In September 2018, SFSD 49-5 voters approved a $190 million school bond (currently the largest school bond in South Dakota history issued with a 4% interest rate and 25 year maturity) with a principal value of $7,932 per enrolled student. In 2020, RCSD 51-4 is asking the taxpayers for a $189.553 million school bond with a principal value of $14,937 per enrolled student or 1.9 times greater debt load on a per enrolled student basis or 1.6 times greater debt load on total property tax base. If the proposed RCSD 51-4 bond was the equivalent size to the SFSD 49-5 bond, the bond principal would be approximately $100.95 million. RCSD 51-4 taxpayers/voters should be asking themselves why there is such a huge discrepancy in the size of debt issuance when measured on either a per enrolled student basis or on total property tax base!

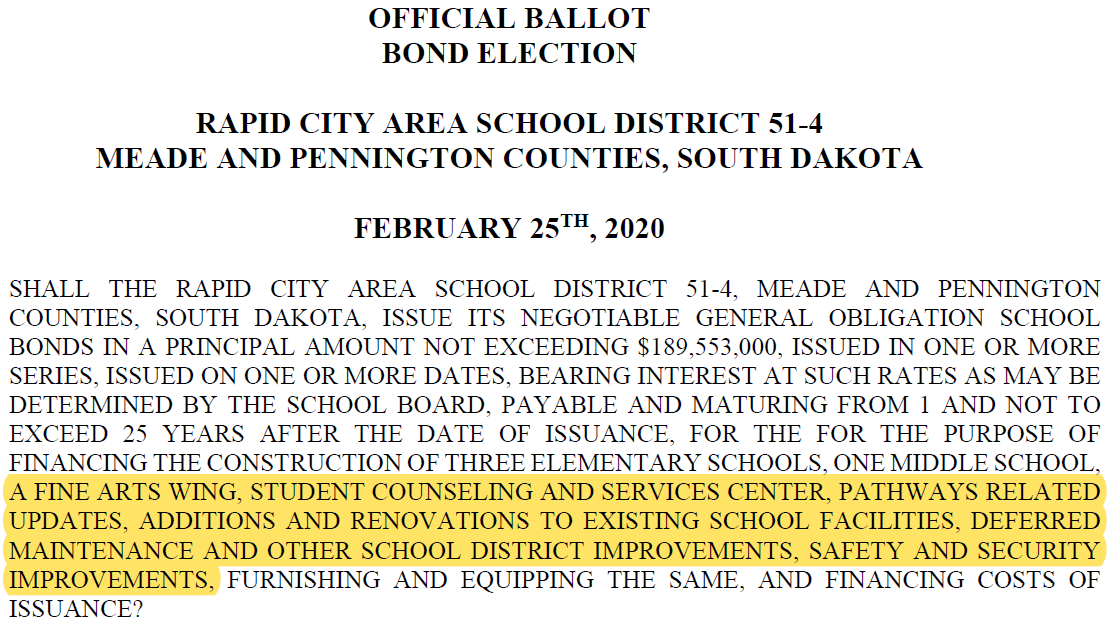

(7) The language of the School Bond resolution as written on the Ballot (reference EXHIBIT 4) is far too general, broad, and open-ended in nature which leaves discretion to the RCSD 51-4 administration to utilize the bond proceeds to fulfill its WANTS instead of student NEEDS – in direct conflict to the purpose of an emergency school bond. Specifically, the portion shown in yellow highlighting below should be stricken from the Ballot language as it is unacceptable due to its open-ended nature which would allow the bond proceeds to be spent on "anything and everything" that the RCSD 51-4 bureaucracy desires. Further, there are $36.9 million of major maintenance projects (small projects generally less than $5 million in cost) included under the $189.553 million school bond. Major maintenance projects should be funded exclusively by the Capital Outlay fund – not by an emergency school bond! Finally, take note that the ballot language never states ANYTHING regarding the exact amount of the mill levy to be assessed to support the school bond. This is INTENTIONAL and grants the Rapid City Board of Education full discretion to change the mill levy at ANY TIME to ANY AMOUNT required to service the bond once the School Bond itself is approved by the voters.

EXHIBIT 4: 2020 $189.553 MILLION RCSD 51-4 BOND ELECTION BALLOT LANGUAGE (SOURCE: RCSD 51-4)

(8) Since the 2015-2016 school year, $5 million per year has been transferred from the Capital Outlay fund into the General fund. As of the 2019-2020 school year, there has been a total of $25 million in transfers from the Capital Outlay fund into the General fund. These transfers were authorized by a majority vote of the RCSD 51-4 Board of Education each year (five times thus far). This $25 million could and should have been used for major maintenance projects, but it appears the Board of Education and RCSD 51-4 administration decided to “run the financial well dry and stick taxpayers with the bill.” The $25 million was used for “anything and everything” but its intended purpose (capital outlays) under State law. This action was an “end run” around the voters who by a 57% to 43% margin rejected a $30 million Opt-Out on 6/2/2015. In other words, the RCBOE ignored the will of the voters and refused to cut the budget in any material way. The RCSD 51-4 taxpayers should demand that $25 million plus interest be transferred from the General fund into the Capital Outlay fund BEFORE even considering any future RCSD 51-4 school bonds, much less the largest school bond in South Dakota history! In a 5/3/18 KOTATV interview titled RCAS flops on funding formula former Assistant Superintendent David Janak states, “We cannot sustain continuing to using capital outlay flexibility to support general fund revenues. When you're taking money away from the fund that is suppose to keep those buildings in service, it becomes a significant challenge for the school district to keep those buildings in service.”

(9) A RECORD amount of taxpayer money has been budgeted and spent by the by the RCSD 51-4 bureaucracy every year from the 2016-2017 school year to the present school year even though RCSD 51-4 student enrollment is down 10.6% from its peak in the 1993-1994 school year. What has been the result of this record spending on Academic Performance? The detailed results are shown on the Academic Performance page, which indicates that Academic Performance has fallen every year from the 2016-2017 school year to the present. Something is clearly broken in Rapid City Area Schools and no amount of taxpayer money is going to fix it!

(10) A narrative has been propagated by the RCSD 51-4 administration and Rapid City Board of Education in conjunction with the local news media that attempts to correlate a slowly growing Rapid City area population to increasing RCSD 51-4 K-12 demographics. This is simply a false narrative as seen on the Demographics page. An analysis of long-term RCSD 51-4 demographics shows a declining student enrollment trend for the last 30 years (13,873 enrolled students in 1991-1992 versus 12,690 enrolled students in 2020-2021). This conclusion is confirmed by the 2016 MGT Report Cohort Survival model (the most accurate model for our specific population dynamics). Long-term Facilities Plans should be based upon an objective analysis of FACTS which simply did not happen. The only thing growing in the RCSD 51-4 is the number of Administrator positions along with their excessive salary and benefit packages!

For all the reasons noted above, on February 25, 2020, please join us in voting NO on the largest school bond in South Dakota history! The RCSD 51-4 taxpayers simply cannot afford to incur an additional $371.6 $390.5 million to be repaid over the next 25 years. A NO vote would send the message to the RCSD 51-4 administration and Rapid City Board of Education to go back to the drawing board to come up with a reasonable plan that the taxpayers can afford and an effective plan that addresses student NEEDS not RCSD 51-4 bureaucracy wants!

2020 $189.553 million RCSD 51-4 Bond Election Ballot Language

SUMMARY DOCUMENT - DOWNLOAD HERE